Pam McClure couldn’t believe her ears when she found out she would save almost $4,000 on her prescription drugs next year. She said, “It seems too good to be true.”

By the end of 2024, she will have spent nearly $6,000 on these medications, including one to control her diabetes.

McClure, 70, is one of the approximately 3.2 million people with a Medicare prescription drug plan whose out-of-pocket costs will be capped at $2,000 in 2025 thanks to the Inflation Reduction Act (IRA) of 2022 signed by the Biden administration, according to a study by Avalere/AARP.

The IRA, a healthcare and climate law that President Joe Biden and Vice President Kamala Harris promote as one of the major achievements of their administration, radically redesigned Medicare’s drug benefit, known as Part D, which serves about 53 million people aged 65 or older or living with certain disabilities.

With this new out-of-pocket spending limit and other significant, but less known, changes, the administration estimates that around 18.7 million people will save approximately $7.4 billion just next year.

The annual enrollment period for Medicare beneficiaries to renew or change their drug coverage, or choose a Medicare Advantage plan, began on October 15 and runs until December 7. Medicare Advantage is the commercial alternative to traditional government-managed Medicare and covers healthcare and often prescription drugs.

Medicare’s stand-alone drug plans, which cover drugs typically taken at home, are also managed by private insurance companies.

“We always encourage beneficiaries to really review the plans and choose the best option for them,” said Chiquita Brooks-LaSure, who heads the Centers for Medicare and Medicaid Services (CMS), to KFF Health News. “And this year, in particular, it’s important to do so because the benefit has changed a lot.”

The improvements to Medicare’s drug coverage required by the IRA are the most significant changes since Congress added the benefit in 2003, but most voters are unaware of them, according to KFF surveys, a nonprofit health information organization that includes KFF Health News. And some beneficiaries may be surprised by a downside: some plans will raise their premiums.

On September 27, CMS reported that nationally, the average premium for Medicare drug plans decreased by around $1.63 a month—about 4%—compared to last year.

“People enrolled in a Medicare Part D plan will continue to see stable premiums and have ample affordable plan options,” CMS said in a statement.

However, an analysis by KFF found that “many insurers are increasing premiums” and that major insurers like UnitedHealthcare and Aetna also reduced the number of plans they offer.

Many insurers’ initial premium proposals for Part D plans in 2025 were even higher. To mitigate the price impact, the Biden administration created what it calls a demonstration program to pay insurers an additional $15 per month per beneficiary if they agreed to limit premium increases to no more than $35.

“Without this demonstration, premium increases would certainly have been higher,” wrote Juliette Cubanski, Deputy Director of the Medicare Policy Program at KFF, in her October 3 analysis.

Almost all Part D insurers accepted the deal. Republicans have criticized it, questioning the CMS’ authority to make additional payments and calling them a political maneuver in an election year.

Regardless of the reason, premiums are rising dramatically for some plans.

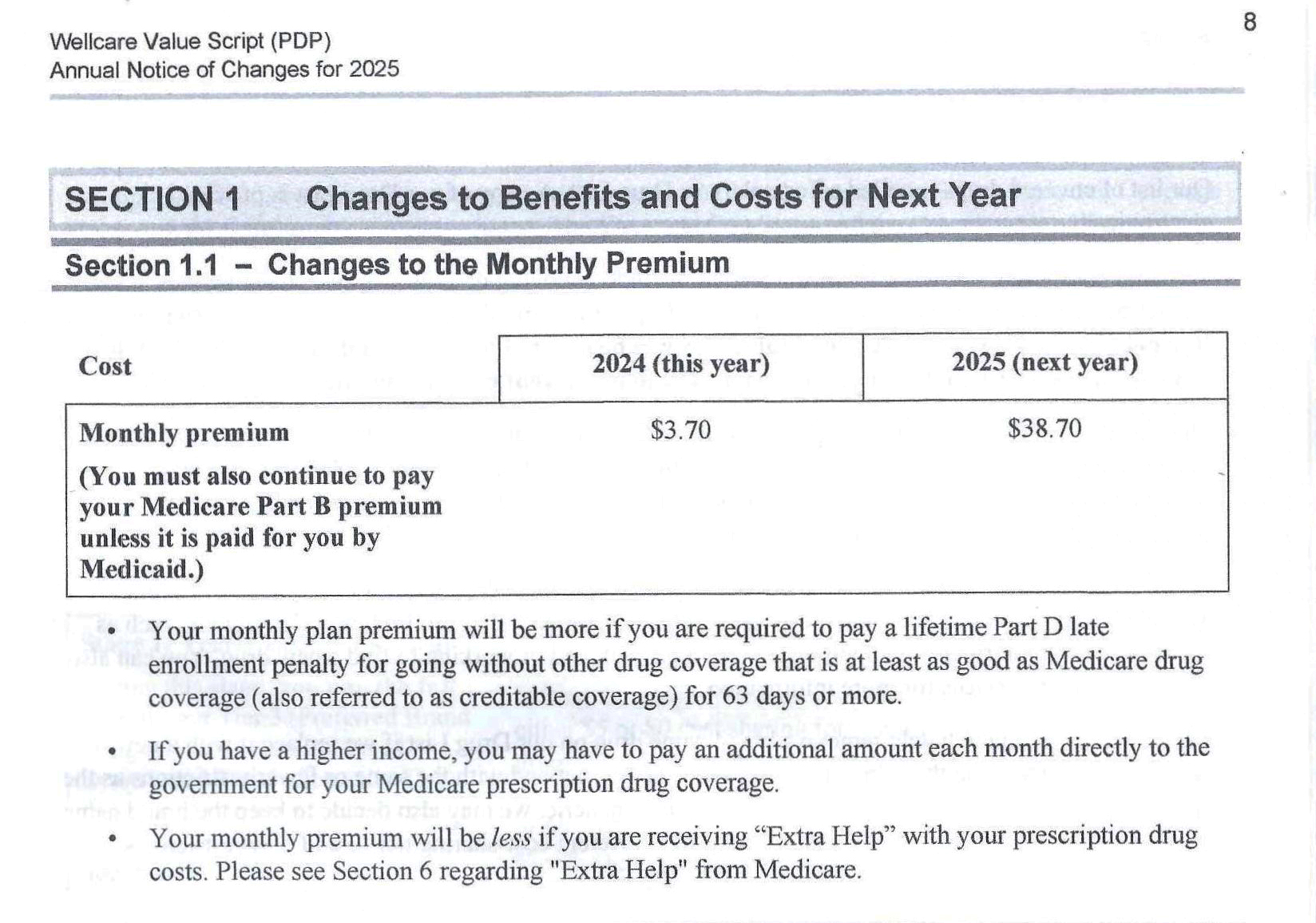

In New York State, for example, the premium for the popular Wellcare Value Script plan increased from $3.70 monthly to $38.70 next year, an increase of $35, over ten times the current cost.

Cubanski identified eight plans in California that increased their premiums by exactly $35 per month. KFF Health News found that premiums increased in at least 70% of drug plans offered in California, Texas, and New York, and in about half of the plans in Florida and Pennsylvania, the top five states with Medicare beneficiaries.

Wellcare and its parent company, Centene Corp., did not respond to requests for comments. In a statement this month, Sarah Baiocchi, Centene’s Senior Vice President of Clinical and Specialty Services, said that Wellcare would offer the Value Script plan premium-free in 43 states.

In addition to the $2,000 spending cap on medications, the IRA limits Medicare copays for most insulin products to no more than $35 per month and allows Medicare to negotiate directly with pharmaceutical companies for some of the most expensive drugs.

It will also eliminate one of the most frustrating features of the drug benefit, a gap known as the “doughnut hole” that pauses coverage just when people face increasing drug costs, forcing them to pay the full price of drugs from their plan out of pocket until they reach a changing spending threshold each year.

The law also expands eligibility for “extra help” subsidies to approximately 17 million low-income people in Medicare drug plans and increases the subsidy amount. Pharmaceutical companies will be required to contribute to help pay for it.

Starting January 1, the redesigned drug benefit will operate more like other private insurance policies. Coverage begins after patients pay a deductible, which will not exceed $590 next year. Some plans offer a lower deductible or none at all, or exclude certain drugs, usually cheap generics, from the deductible.

After beneficiaries spend $2,000 on deductibles and copays, the rest of their Part D drugs will be free.

This is because the IRA increases the portion of the bill assumed by insurers and pharmaceutical companies. The law also aims to curb future drug price hikes by limiting increases to the consumer price inflation rate, which was 3.4% in 2023. If prices rise faster than inflation, pharmaceutical companies must pay Medicare the difference.

“Before the redesign, Part D incentivized drug price increases,” said Gina Upchurch, a pharmacist and executive director of Senior PharmAssist, a nonprofit organization in Durham, North Carolina, that advises Medicare beneficiaries. “The way it’s designed now puts more financial obligations on the plans and manufacturers, pressuring them to help control prices.”

Another provision of the law allows beneficiaries to pay for drugs in installments, rather than having to pay a hefty bill in a short period of time.

Insurers must do the calculations and send a monthly bill to policyholders, which will be adjusted if drugs are added or removed.

In addition to the major changes introduced by the IRA, Medicare beneficiaries must prepare for the inevitable surprises that arise when insurers review their plans for a new year. In addition to raising premiums, insurers can eliminate covered drugs and remove pharmacies, doctors, or other services from provider networks that beneficiaries must use.

Missing the opportunity to change plans means coverage will be automatically renewed, even if it costs more or no longer covers the needed drugs or preferred pharmacies.

Most beneficiaries cannot make any changes to their plans or switch to others outside of the annual enrollment period unless CMS grants them a “special enrollment period.”

However, many do not take the time to compare dozens of plans that may cover different drugs at different prices in different pharmacies, even when the effort could save them money.

In 2021, only 18% of enrollees in Medicare Advantage drug plans and 31% of members of stand-alone drug plans compared the benefits and costs of their plan with competitors, according to KFF researchers.

For free and unbiased assistance in choosing a drug plan, beneficiaries can contact their state’s State Health Insurance Assistance Program (SHIP) at shiphelp.org or at the helpline 1-877-839-2675.